"One who when bought, stays bought."

Commodore Vanderbilt, describing in the politics of his day, an honest politician.

"Along with ordinary happenings, we fellows in Wall Street had the fortunes of war to speculate about and that makes great doings on a stock exchange. It's good fishing in troubled waters."

Daniel Drew, quoted in The Robber Barons, Matthew Josephson, page 59.

The years from 1857 to 1873 were all about railroads – many of which were listed on the New York Stock Exchange - and about the men who fought to control them. This age, of which 1857 to 1873 was a large part, came to be called the Gilded Age, and for good reason. What happened, the wealth created and then lost, the speculation and the corruption, was astonishing. Did I say railroads ? Yes well this is true, but underlying the rails was a land give away and as we shall see, the railroad speculation was often more about collecting the value of what the railroads ran over, rather than the railway itself.

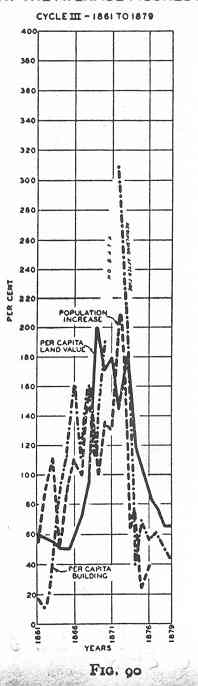

Charles Dow, in his studies on business conditions, observed the following about the 1860's: "The London panic in 1866, precipitated by the failure of Overend, Gurney & Co., was followed by a heavy fall in prices in the Stock Exchange here. In April there had been a corner in Michigan Southern and rampant speculation generally, from which the relapse was rather more than normal." (William Peter Harrison, The Stock Market Barometer, page 26.) Our mid cycle slowdown, an established feature in the (on average 18 and a half year) property cycle by this era. About the 1873 panic, Harrison quoted Dow as saying: "The panic of September, 1873, was a commercial as well as a Stock Exchange panic. It was the outcome of an enormous conversion of floating into fixed capital. Business had been expanded on an enormous scale, and the supply of money became insufficient for the demands made upon it. Credit collapsed, and the depression was extremely serious." Let us carry out a repeat analysis and see what Charles Dow, as quoted by William Harrison, was attempting to explain.

The 1857 downturn ushered in a good deal of soul-searching leading to a marked religious revival in most of the country, especially the towns and cities. Clergymen were heard addressing their flocks that the autumn (1857) panic had been punishment well deserved after all the ostentatious display and 'criminal extravagance' of the time. Prayer meetings in New York were found attended by bankers, merchants, clerks, lawyers and even the brokers themselves. The 'Businessmen's revival' it was termed, the meetings taking place as they were, at lunchtimes. After one's earthly hopes have been ruined, where else ought one turn ? And besides, since it appeared mere mortals were incapable of ending the depression, perhaps God could do it. The newly found piety led one Massachusetts editor to muse: "If the pressure should be lifted, we fear Wall Street will lose its interest in the noon prayer meeting, and return to its old modes of preying." (Springfield Republican, Nov 7th, quoted in Stampp, page 238.) The brokers did not have long to practice singing the Lord's praises, for soon (civil) war broke out (April 12th 1861), though tensions had been building for years. Long lines formed at the White House in the hope of receiving a lucrative military supply contract.

It is not our place here to delve too far into this central event in US history, though one area of interest, as regards dates, is the history of John Brown. In such emotional historical events, after a bit of Gann enlightenment, a habit ought to be acquired to study any dates and times. (Perhaps John Brown could be labelled America's first holy warrior - prepared to kill and be killed for his beliefs, in the name of religion.) Anyway, May 23rd 1856, the Pottawatomie massacre, starting war in Kansas between pro and anti-slavery forces. 41 months later, October 16 - 18, 1859, Harpers Ferry shoot-out. Those monthly Gann dates. Trial November 2nd (a 45 minute deliberation), hanged December 2nd, 30 degrees later, 45 degrees from the Harpers Ferry events, 43 months from the first atrocities. (42 months is 180 weeks.) 120 years later, pressure arose in his name, the John Brown Brigade against the Ku Klux Klan. (American Heritage, Feb / March 2000.) Just dates and times…

In 1860, the government finally declared itself in favour of free homesteads for settlers. The Act, duly passed after Lincoln won the Presidency, offered totally free, a quarter section (160 acres) of government land to any adult US citizen prepared to move and stay on the land five years. Within three years one hundred thousand people had taken up the offer. Another small kick-start out of recession. We have run out of unclaimed land with which to do that nowadays, unless you want to go to the Amazon. The homesteading idea actually went back to the days of Jackson in 1832, and was pushed by many people tiring of the land speculation going on around them and the ever-increasing concentration of ownership into fewer hands and larger estates. Opposition to the act had been continual however. The big fur trading companies (Astor etc) didn't like it; the settlers were making it harder to catch the fur bearing animals. Owners of Eastern US lands didn't like it because it would further draw people to the west, and away from the east; and population was required to maintain eastern land values. The Southern members of Congress were determined never to have such an act see the light of day, as it would immediately threaten the slave system. In the early days of Congress, numbers of states had been finely balanced, 13 slave states, 13 free. But new states were being added to the Union every decade and under the strongly held principle of state sovereignty, each state had the right to choose its destiny, slave or free. Encouraging even more settlers to the west - there was plenty going already - would add to the numbers declaring free, not slave state, hence threatening the very survival of the south's plantation system and slave holding in general. It was this very question, and the violence that erupted in Kansas because of it, complete with our fellow John Brown, that brought on the civil war. This war was as much about land ownership as it was about slaves. "If the Homestead Act for free land had been adopted in 1832, as suggested by President Jackson, instead of thirty years later, after the war began, slavery would have died a natural death, as the Homestead Act would break up land monopoly in the south." (Roy M Robbins, Our landed Heritage, quoted also in Chandler, page 502.) Conjecture of course, but opposition to homesteading from the south never wavered; so they were obviously protecting some sort of privilege. Now that the South had ceded from the Union, (these states did so after Lincoln's pledge to pass the bill, and his further pledge to oppose the spread of slavery), numbers were more favourable for the Acts passage.

Non-settlers still found ways to accumulate more land than the law allowed under the Act however. By means of dummy entries at the land office, or of cabins built on wheels and movable, or placing the homestead living quarters at the intersection of quarter section adjoining lines, the intention of the Homestead Act was circumvented and the land still accumulated by speculators.

Civil war.

The onset of civil war (1861 to 1865) saw develop the biggest era of speculation ever experienced in the US up to that time; starting slowly at first and expanding the longer the decade went. Newer, younger men had come to replace the older, more conservative brokers on Wall Street that were wiped out by the 1857 panic. Markets were initially undecided about the possible effects of north versus south, and nervous. A stock market decline took place in the lead up to war, and after the events at Fort Sumter, a bit of a sell-off. But in 1862 once the Union decided how to pay for their side of the fighting by issuing $150 million worth of paper - the new 'greenbacks' as they came to be called - and by the selling of bonds, markets started climbing. (Not dissimilar to the events of 2003, though the Bush administration did not issue paper in the form of currency to pay costs, but is issuing bonds.) The selling of bonds is an expansion of the money supply, being inflationary in its tendency. Markets are quick to figure this out, and the historical facts of past episodes are never lost on the remaining older players. Cause and effect repeating. Government spending money to pay for the war, buying armaments, clothing, food, rations, paying railroads for transport, iron mills, textile manufacturers, the list would be endless, profits would most likely increase, the financing needs significant. 'Good fishing in troubled waters', as Daniel Drew pointed out. The previous downturn was fast becoming history.

Markets are also quick to set up systems to gather relevant information. The 1860's gold market in particular was usually the first to learn of related war news and developed extensive spy networks in both Union and Confederate camps to relay information. In this way markets generally knew the war news before the president himself knew.

Call loans.

Taking a loan from the bank, and offering your shares as security was not a new idea in this era; it had been going on since the days of the markets in Amsterdam back in the 1600's. But it was not that common in the US until the 1850's, at which time such loans started to dominate the New York exchanges. Suffice to say, if you wanted to play the markets, it was becoming increasingly easier get a loan from your broker, with money (credit) supplied to him from the banks, with the shares so bought as security for the loan. The effect was to make Wall Street more susceptible to monetary conditions and the prevailing movement of interest rates. It also attracted a lot more people to the market.

The increasing speculation.

It was all about access to and control of the rent, as it has always been. Edward Chancellor, (Devil Take the Hindmost) in his excellent review of this era, had already noted, (page 155) and we might recap by quoting it: "America's vast wilderness invited speculation. Many of the country's founding fathers were land speculators: George Washington started his own Mississippi company to purchase lands in the west; Benjamin Franklin was involved in an Illinois land speculation of sixty-three million acres; Patrick Henry, the fiery revolutionary, was among the investors in the 'Yazoo Company', which attempted to purchase ten million acres in Georgia; even Thomas Jefferson and Alexander Hamilton were occasional 'land-jobbers'. For a century after independence, the country was in a constant ferment of land speculation. In the late eighteenth century, millions of acres in large blocks were exchanged in Maine, Georgia, and New York State. The developing towns and cities were also the objects of speculation. Fittingly, the capital city, Washington, D.C., was founded by land speculators. Forty years later, Chicago was the new boomtown. Later still, the railroads opened up the western part of the country to the national pastime, the railroads themselves, established with federal land grants that exceeded 170 million acres, were primarily vehicles for land speculation."

Which brings us to the railroad story, which involves the stock market and government land grants. There were plenty of other 'boomlets' over the course of the cycle, which we will take note of in a minute. However the big guns were operating in the stock market because the federal lands so granted were usually transferred to a land company, organised and owned by the promoters and the railroad company shareholders. And it was a lot of land, so it is on the rails that we will concentrate our study of this cycle. The story to 1873 goes like this:

Historians seem in agreement that the civil war, despite the atrocious loss of life, created a speculative mania the likes of which had never quite been seen before. "Almost every man who had money at all employed a part of his capital in the purchase of stocks or of gold, of copper, of petroleum, or of domestic produce, in the hope of a raise in prices, or staked money on the expectation of a fall." (Chancellor page 165)

Not that the federal government always approved. Lincoln tried to ban the trading of gold, considering it unpatriotic based as it was on events in the war - the price of the metal tending to rise with confederate victories and fall with union wins - but he did not succeed. Gold trading reached a climax in early 1864 with the opening of a new gold exchange, but panic hit on April 18th with the failure of the speculator Anthony Morse. Exuberance revived in 1865 with trading in the new black gold - petroleum; a substance hailed for its vermin killer qualities, for its use as a disinfectant, or for "hair oil, boot grease and a cure of kidney stones". (Chancellor page 170.) In fact the product was so new, nobody really knew what it could be used for. It was easy for the brokers though, who simply discarded from their offices the gold samples, and installed new petroleum philes and oil barrels in their place, to advise buyers of the pros and cons of the next certain winner.

The (Union) government also borrowed - heavily - to finance its war operations. (There are only three ways to pay for the costs of war; print money, borrow, or raise taxes.) Perhaps concluding that the existing Wall Street methods of raising bond finance might possibly be insufficient, the government turned to a new banker, Jay Cooke, of Jay Cooke and Co (Jay was well connected to the government via friends) to raise additional finance. Jay hit upon the novel, but then untried method of advertising the government bonds in local newspapers and flyers. A smash hit. Monsieur Cooke ensured through extensive advertising that people knew it was their patriotic duty to part with some of their cash and buy the bonds, and buy them they did. The new 'mums and dads' bondholders had now been introduced to the intricacies of Wall Street bond markets.

With the advent of the telegraph and railways, even some of the more remote places in the US could look forward to daily contact with 'the markets'. Out went the sedate closely connected brokers, going home for their lunch time meal, in came the 'counter lunch', so called because it was literally eaten at the counter, and an influx of new brokers, operating in any of the new exchanges open for business, or 'on the curb'. "By 1863 they may well have been trading as much as a million shares a day on the street." (John Steele Gordon, The Great Game, page 97.) By 1865 volume was reckoned at $6 billion a year, with some brokers earning up to ten thousand dollars a day in commissions, when $1000 a year was considered a decent wage. (James K Medbury, Men and Mysteries of Wall Street.) And if still one had not had enough action for the day, there were always the night markets conducted in nearby hotels. In these war years, 24/7 trading was just about doable.

In the meantime, whilst the public were being reminded of their patriotic duty to support the war effort and buy bonds, the war contractors were busy filling their government contracts. "Cornelius Vanderbilt furnished the navy with unseaworthy vessels, the young Pierpont Morgan sold faulty carbines to the army, and other contractors supplied goods to the government that were equally 'shoddy' (the word derived from a material made from shredded rags used for union soldiers coats." (Chancellor, page 174) The civil war profiteering flourished under the Secretary of War, Simon Cameron, who was continually issuing military supply contracts without competitive bidding. President Lincoln did eventually replace him, but not before Union soldiers had received "knapsacks that came unglued in the rain, uniforms that fell apart, and guns that blew the thumbs off the soldiers firing them." (See the site hnn.us/articles/880.html) The defective rifles were supplied by one J P Morgan, who had financed the deal to buy 5000 from a Union Army depot in New York for $3.50 each, then on-sell them to the soldiers already in Virginia for $22 each; Morgan taking 25% commission. (Washington Post, Feb 10 2002, page F01) Soldiers got boots made largely of paper, they got meat that came largely from diseased cattle and hogs. (Holbrook, The Age of the Moguls, page 20.) Most of the contractors had already made their initial war investment by paying substitutes $300 in order to dodge the draft. A modest investment.

Never aspire to be a part of 'the public'. The public's ignorance condemns it to perpetual slaughter.

In 1867, after the war, came 'the ticker'; a new invention using the existing technology to indicate the very latest stock prices to the observer, without having to be anywhere near the exchange. Truly a revolution. (The ticker created a bit of a paper glut, which the New Yorkers solved by inventing the ticker tape parade.) The first stock market 'bucket shop' (perhaps one could liken them, unfairly, to our - in Australila - TAB's), followed soon after. Stock markets were now big business for little people. But to protect them against any unfair business practices and market scams, regulation had not yet been given any consideration. Indeed, government ethics were probably worse.

The stock ticker had followed hard on the heels of the, this time, successful laying of the transatlantic cable in 1866. New York was 'talking' - well sort of - to London. 1866 was also the year, just out of interest, Jesse James turned outlaw, launching his criminal career in February with a bank hold up in the town of liberty, Missouri. Takings were about $57,000. (Their first train hold up was a few years - 89 months - later, 21st July 1873, the Chicago and Rock Island express, near Adair, Iowa, the outlaws having stopped the train by removing a portion of the track. In 1875, Pinkerton agents, the forerunner of the FBI, tried to firebomb the James' family farm and kill the outlaws, but succeeded only in raising sympathy levels for the gang, seen by many as robbing the rich - banks and trains - who were exploiting those who could least afford it.)

Soon it seemed as if the whole nation was copying outlaw Jesse and trying to get rich quick, not by robbing banks, but by trading markets. "The mania seemed to possess everybody, Fraser's magazine told its readers in 1869. Old-fashioned merchants abandoned the principles of a lifetime and 'took a flyer', or in other words, bought a few hundred shares of Erie. Professional men, tired of the slow gains; clerks sick of starvation salaries; clergymen, dissatisfied with a niggardly stipend, followed fast in the same course. Even the fair sex, practically asserting women's rights under the cover of a broker, dabbled in Erie shares." (The Great Game, page 109.)

It was in this year, 1869, that Jay Gould, with Jim Fiske as his agent, sought to corner the gold market. "Success for these notable scoundrels depended on the government's not selling gold, which Gould thought he had ensured by buying Grant's brother-in-law (and thus the President) and also a minor official or two. His men couldn't, as it happened, deliver Grant." (Galbraith page 105.) The corner fell over. The collapse and ensuing gold market panic occurred September 23rd and 24th. Notably, the mere fact that such speculators, as well as the general public, were prepared to believe that those in power could go along with such a scheme gives one an idea of the general opinion of politicians at this time. And not just of politicians either. Fraser's magazine was at great pains to explain to its English readers that in New York there is a custom among litigants, "of retaining a judge, as well as a lawyer." (Fraser's, May 1869.) Later Congressional hearings into the whole gold matter asked Gould and Fisk what had happened to the profits. Fisk responded that they had gone 'where the woodbine twineth', a phrase that immediately captured the imagination of the country. Woodbine, otherwise known as honeysuckle, was often planted around outhouses to mask unpleasant odours. (Gordon, The Great Game, page 135.)

It might be noted that the collapse of the attempted gold corner did not lead to a severe downturn. Land prices had not yet risen to levels high enough to threaten the banking sector.

In these years government was seen as part of the problem of efficient markets, not as part of the solution. Nor was regulation of any market seen as part of government responsibility. Regulation was left to participants themselves, which did eventually take place when enough brokers finally tired of all the shenanigans. Railroads were the main game and it is here (in addition to banking of course) where the big operators could be found: the colourful characters collectively labelled for posterity as The Robber Barons:

- Daniel Drew, known also as 'the great bear', 'the old bear', 'ursa major', 'the sphinx of Wall Street', or just plain old 'Uncle Daniel'.

- Jay Gould, John W Tobin, Henry Keep (Henry the silent),

- 'Commodore' Vanderbilt

- Hetty Green, The Witch of Wall Street, (ended up the richest woman in the US)

- Addison Jerome and brother Leonard (eventual grand-father of Winston Churchill)

- Anthony Morse, (The lightning calculator)

- Thomas Durant and Oakes Ames (the king of spades)

- J P Morgan

- John 'bet-a-million' Gates

- Jim Fisk (otherwise hailed as Prince Erie, Jim Jubilee, or Admiral James Fisk, Jr.)

And many others. Much has been written about the exploits of the barons, no need to repeat that here. John Steele Gordon's The Great Game, chapters five six and seven, or Edward Chancellor's Devil Take the Hindmost, chapter six, make great reading, to name just two of the many books. We will take a different perspective to all the others, naturally.

The railroads and land grants story.

"We'll buy the lands on long time, backed by the notes of good men; and then mortgage them for money enough to get the road well on. Then get the towns on the line to issue their bonds for stock…we can then sell the rest of the stock on the prospect of the business of the road… and also sell the lands at a big advance, on the strength of the road."

The story of the eastern railroad promoter, Mr. Bigler, and his plan to build the Tunkhannock, Rattlesnake and Youngwomenstown railroad, which would not only be a great highway to the west, but would also open to the market the nearby inexhaustible coal-fields and untold millions of lumber. From The Gilded Age: A Tale of Today, a novel by Samuel L Clemens and Charles Dudley Warner.

Assistance from the government to build the country's railway network began in the form of land grants; the first in 1850 when the state of Illinois was given 2.5 million acres of prime public domain to help with the construction of the Illinois Central. By 1857, railroad projects in the western and southern state areas had received 22 million acres of land to 'assist' with their building. And as any railroad book of the era will tell you: "The grants proved to be a stimulus not only to the railroads but to land speculation and to a considerable amount of corruption growing out of the competition of rival promoters for a share of the land at the states disposal." (Stampp, America in 1857, page 215.)

It was Stephen A. Douglas, senator for Illinois, that in 1853 convinced the federal government, already accepting of the need to build a railroad to link east and west, that it could best be built by private enterprise, with perhaps just a little assistance from government in the form of land grants. Odd then, (or perhaps not so odd in the light of how closely the value of government granted licenses depends on the government), that during the long years of the previous economic downturn, when calls were made by public officials and citizens for the government to 'appropriate funds to feed the hungry through a program of public employment', such arguments were virulently attacked by the ruling politicians and newspapers of the day as being anti American. "Honest citizens would be unjustly taxed for 'extravagant and unnecessary' public works, and the 'thriftless and disorderly' would be taught to look for government support." (Stampp page 228.) It was suggested that the unemployed might head west; that self-help was the American way. Such was the laissez-faire attitude within the ruling class at this time. Except for funding the railroad interests.

Southern interests originally opposed the building of a railway to the Pacific coast unless the line ran via a southern route. But with the South now having ceded from the Union, bills granting the promoter's right of way were passed in 1862 and 1864. The lines were named the Union Pacific and the Central Pacific, to be built along the 42nd parallel. In addition to rights of way, Congress granted the lines 19.5 million acres of land, and two loans of United States Government 6 percent bonds, the accrued interest on the loans for the thirty year period to be paid semi-annually by the government.

With the land grants, the rail company would sell off the land as and when the building of the line made the land more valuable. The promoters also chose, naturally, to issue securities to the public via the stock market, both bonds and shares, to raise much needed revenue and construction finance, which in turn kicked off wild manias and pitched battles on market, for control of these enterprises. And as we noted in the previous chapter, farmers near to the rail lines were often 'enticed' to part with their hard earned cash, or indeed loaned money on the basis of their farmland as security, to buy railway shares; the railway company then bundling up all the mortgages - securitising them - and on-selling the bundle to eastern bankers. Further credit expansion, backed by land value.

It is probably also not hard to imagine all the towns along the way fighting to get the line built through 'their' village, or have a station 'strategically' placed to bring in new business. Perhaps a little 'inducement' could be offered to locate our line in your vicinity ?

In all, between 1850 and 1871, the year the final land grant to a railroad was made, promoters of a total of 72 railroads received some 94 million acres of land. There had also been roughly 36 million acres of federally controlled land granted to the states to further railroad building. It was specified by Congress that such lands should be only agricultural, coal or iron lands. But it was not uncommon for the rails to get their hands on "other valuable mineral lands…with all the gold, silver, copper and oil under them, and all the timber and stone above them, with all harbor rights and franchises" out of fraudulent surveys carried out by dishonest public officials. (Chandler page 504) Hence no lack of interest from powerful quarters in rail stock.

The (insider) promoters were often a further step ahead of mere investors in other ways than just land grants too. In the case of the Union Pacific, the behavior of insiders gave rise to the most highly publicized fraud of the era, the Credit Mobilier scandal. In The Great Game is a good description, page 137: "The construction (of the line) was subsidized by granting the railroad millions of acres of land along the route, land that would become much more valuable once it was accessible by the railroad. To feather their own nests, the management of the Union Pacific set up a construction company with the fancy French name of Credit Mobilier, then hired this company to construct the railroad. Credit Mobilier wildly overcharged the railroad to do so, making the shareholders of Credit Mobilier millions while draining Union Pacific, and thus its stockholders, dry. To make sure there was no interference from Washington, management bribed many members of the Grant administration (including his first Vice President, Schulyer Colfax) and Congress. Rather than cash, the Union Pacific executives gave them sweetheart deals, allowing them to buy stock in Credit Mobilier and pay for it out of the enormous dividends."

But the story of the scandal starts with Thomas Durant, who believed there was more money to be had in building a railway, than actually operating one. After having already had some involvement in running other western area railroads, one of which he used to smuggle in illegal cotton shipments from the south to the north during the civil war, he set about lobbying Congress to grant land and bonds to the Union Pacific company (UP) to build a transcontinental line; a company of which he was now Vice President. Once granted, Durant then had an associate supply a construction bid to the UP for construction of the road. The UP accepted the bid, which Durant then had transferred to his own company, styled just for the purpose, the Credit Mobilier. This proved a neat bit of corporate organization. The UP was receiving government subsidies for every mile of track built. The Credit Mobilier was charging UP for the actual construction. UP wore all the risks, (and was also the company in which the public was invited to invest its money), whilst Credit Mobilier took all the profit. And the Credit Mobilier substantially overcharged UP for the costs of building, thus ensuring a good deal of profit. And of course for the Credit Mobilier company it was irrelevant whether the line was ever eventually profitable or not, nor indeed how much it might eventually cost, since Credit Mobilier did not have any liability in the project. And the profit, once earned, could not be taken back. (Actually, the more the line cost, the more money these guys made.) So as you have guessed by now, Durant had effectively hired himself to build the railway, paying Credit Mobilier with the money given to UP by the government. Construction got off to a great start out of Omaha with the building of a few extra curvatures, adding nine additional but unnecessary, though profit-generating miles to construction.

It appears that after the civil war, the operations of the UP were taken over by Ames, now a rail man, but also a member of Congress, who ousted Durant in a board room tussle. Known as the King of Spades, Ames had made his money originally from a shovel business supplying spades to the miners, a business that had been founded by his father and one that became very profitable after the discovery of gold in California. Hence the title. To ensure the continued goodwill of the government towards the UP, Ames distributed Credit Mobilier stock to 'strategic' legislative members. To give an idea of the profits of holding this stock, in 1867 the Mobilier declared a dividend worth as much as its entire capital. In this way, Ames and his 'group' made off with profits that some estimated at $44 million, though the real figure is not known, and was probably a bit less. Importantly for our story, it left the UP with very large debts, (at the mercy of prevailing interest rates), that would have to be serviced out of future profits. The scandal broke in January of 1873. In his enthusiasm for the project, Ames had "unwisely solicited some members of Congress to buy stock in the Credit Mobilier Company of America, owned by the promoters, which had the contract for building the roads - not from need of any small capital thus obtained, but to secure their support in Congress of any future desired legislation concerning the undertaking." (Chandler, page 505.) For this Ames was expelled from Congress, though many members later apologized to him for having voted him out merely to satisfy the public clamor. No charges for the looting were ever laid.

Nor was this the only scam to come to light with the building of the railroads. Over level desert and prairie lands in the west, "tracks were not always laid straight as one might have anticipated, but meandrically". This gave the promoters increased track mileage, i.e. more land grants, "and an increased amount of railroad company bonds - which were issued to the promoters construction companies at from $15,000 to $25,000 for each mile of road constructed." Not too many years later, most of the railroads went bust through high operational costs due to poor construction and high interest charges on the bonded debts. "Thousands of miles of road had to be straightened, shortened or rebuilt. The operations were carried out through receiverships and financial reorganisations, at great loss to the bondholders. But the land companies continued to be profitable." (Chandler, page 508.)

Some rail trivia.

Railroads made an awesome impact on just about everything, not just matters economic. Aside from the cheaper transportation costs, there was now a year round quicker, and probably much safer carriage of goods and people, vastly extending the reach of the market economy. Not to mention the expansion of the iron, steel, wood, coal and machine building tools that went with it. Practically everything about the rails was new, or required re-inventing.

The railroads quickly replaced the stagecoach services operating to get passengers from Missouri - the rail terminus at the time - to San Francisco, and the pony express that operated to take US mail across the continent. Passengers swapped 25 sleepless nights in a coach for the more luxurious week long conditions of a steam driven carriage.

Railroads were pretty much the first 'corporate' employers. Prior to this, most workers were not really involved in an employee hierarchy. In the early days of rail, employment was often seen as a 'calling'; it being quite common for example to see engine-men on their only day off - a Sunday - back at the office shining the brass on 'their' steam locomotive. Engine-men were a proud lot. It was not unheard of for them to combine with conductors and run the line to suit themselves and if living near to one another, make every effort to be home at night, train and all, where they could layover until next morning. At least in the beginning. Spare a thought too for the early pioneer locomotive drivers and cabmen; they drove in open cabs without protection from the weather, sparks and smoke. The travelling public simply would not permit covered cabs in order that the driver's alertness and constant attention to the task at hand could be monitored. Engine-men could also earn an additional twenty dollars or so for being the first to drive their locomotive across any newly built bridge, testing the bridge for its safety. And small gratuities would sometimes be paid them if the train was carrying important dignitaries, politicians or the more wealthy stockholders. (Probably the safer option to increase earnings.)

Train conductors became men of some importance and theirs was an employment category much sought after. Landing a job here allowed for very swift elevation up the social ladder. Conductors often wore top hats and fancy gloves, with adorning and elegant timepieces. So important to the trains did they become that some train journeys were designated by conductor name rather than by number or destination. (Smith to meet Jones at La Salle, for example.) Conductors were also made responsible for printing and issuing journey tickets too, at least initially; a fact not lost on these men as an additional source of income. The Philadelphia and Reading railroad discovered eventually that they were losing 32% of ticket revenue - 18 cents per mile - to conductors after an audit by Pinkerton's National Detective Agency. (Licht, Working for the Railroad, page 96.) Early conductors carried potable water (a penny a cup) and were not unknown to accept bribes from male passengers wanting entrance to the ladies compartment.

The rail builders ended up large employers of Chinese labourers - the Chinese would happily work for less. ($32 a month, rather than $52.) Perhaps no coincidence, the senate passed in 1868 a treaty permitting immigration, without restriction, from China. In later cycles, many labour disputes arose with the Chinese immigrants, from feelings that 'white' jobs were being pinched.

Work was for most a ten to twelve hour day; on at 7am, off at 6 or 7pm. On Saturday's it might have been permissible to leave an hour early. This meant a seventy-hour workweek, though there was no contract as such. If work was available, one got 'called'. If not, the saloon was the only other 'employer'. Payment was not always guaranteed weekly either. There were plenty of stories of workers going without wages for up to 6 months at a time, or of receiving scrip in payment of wages, or even, in the states where it was permitted, of being paid in railway printed bank notes.

Of course the workers were all men; female labour being relatively unheard of in those days. There was the occasional exception however. A Miss Minnie Rockwell was taken on by the Chicago, Burlington and Quincy line as a station telegraph operator, the line's controller (Robert Harris) apparently known as a bit of a feminist and champion of reform causes. Alas, Miss Rockwell became somewhat of a 'curiosity', attracting the attention of a 'rowdy element' that disrupted the routine of the station. (Licht, Working for the Railroad, page 216.) Whether Miss Rockwell quit or was fired has been lost to time, so the policy of hiring women had to wait a few more years still.

To the god-fearing, church going citizens of the western states, depravity also followed the coming of the railroads all the way west, as well as the benefits already alluded to. A heady brew of whisky, guns, gambling and vice it was too that formed in the instant boom-towns that sprang up ahead of the rail line serving grade crews and line workers; the towns serving also as jumping off points for those hardy souls venturing even further west. This was particularly so in the case of the Union Pacific, the railway built to connect East and West. The Rector of St Mark's Episcopal Church, the Reverend J. W. Cook, in one of the new towns named Cheyenne reported as he arrived in 1868: "The activity of the place is surprising and the wickedness unimaginable and appalling. This is a great centre for gamblers of all shades, and roughs and troops of lewd women, and bullwhackers. Almost every other house is a drinking saloon, gambling house, restaurant or bawdy." (wyomingtalesandtrails.com/sherman3.html) More rail workers were killed in such towns than by any manner of accident on the lines themselves. Some of the towns, notably those that serviced line division points, stayed and prospered. Other towns simply disappeared or moved further west as the ever-extending westward construction teams moved on. Hence the term 'hell on wheels'. It was said that in the town of Benton during its brief existence, more than 100 souls met their Maker in gunfights. When the Echo Canyon saloon was torn down some seven human skeletons were unearthed under the floorboards. And when the Union Pacific reached Utah, a territory founded by the Saints (Mormons), the locals were mortified by the immorality of the characters escorting that road's advance.

"The printed train schedule, the conductors gold timepiece…the pace of life had quickened and become more ordered." (Licht, Working for the Railroad, page 79.) The roads were changing everything: "They come and go with such regulated precision, and their whistles can be heard so far, that the farmers set their clocks by them… Have men not improved somewhat in punctuality since the railroad was invented ? Do they not talk and think faster in the depot than in the stage-office ?" (Stewart Holbrook, The Story of American Railroads, page 15, quoting Thoreau.)

And as regards the land, it was fast becoming obvious to everyone by the mid to late 1860's that railways were becoming a huge 'loot' of the public domain, as noted later by many historians, Gustavus Myers (History of the Great Fortunes) in particular. Best get in before there was no more land to hand out. Although the government sought perhaps to pre-empt the speculators getting their hands on the land granted to railways by releasing it in alternate sections, that is, not contiguous to the line itself, in practice this was easily countered. The alternate sections were not always marked as such, so homesteaders could not determine which land was government and which belonged to the railway company; or if the section was marked, railway workers pulled up the markers. Rail companies knew the land was going up in value; why rush to sell something that everyone knows will be worth twice as much tomorrow ? And besides, the 'even' sections retained by the government could, if absolutely necessary, be gained by the railroad through the use of dummy entry-men at the nearest land office.

And so it was in this manner that the rails - a speculative land gamble - brought down the probable financial genius in Jay Cooke; that 'unlooked for' event of 1873.

Jay Cooke and the Northern Pacific, part I.

The Northern Pacific railroad was chartered originally by Josiah Perham, a Boston wool merchant, and his associates. Perham lost his first fortune in an unwise land speculation of 1837, but made another one advertising and selling cheap railroad excursions for the public to visit Boston for the day. The Northern Pacific (NP) had been granted 43 million acres of the public domain (alternate sections of land ten miles wide, both sides of the track) to build a line connecting Duluth, on Lake Superior to Puget Sound. Not initially successful, the line came into the hands of Jay Cooke in that banner year of 1869. Cooke proceeded to put all his energy into running it, eventually sending him bankrupt. But before relating this story however, we need to relate his prior profound effect on the US banking system, and also a bit more about Chicago.

Banking.

The banks were not in great shape after the downturn of 1857 and arrival of the civil war, to say nothing of all the different bank notes in circulation. Recovery took some years. By way of one example, Hoyt gives figures for the state of Illinois bank note circulation of around $12 million in the late 1850's, backed by deposits of $14 million in bonds, about two thirds of which were southern state bonds - a weakening security base, destroyed completely once the South were defeated. By 1864 only 23 banks were still trying to stay in business. Generally, Hoyt had also noted, (page 76): "A situation in which there was circulating in the United States 7,000 genuine notes of 1600 different state banks of issue which were at varying rates of discount, mingled with which were 5,500 varieties of altered and counterfeit notes, was a serious handicap to every type of business." To say the least. This situation was completely reversed by the national banking act drawn up in 1863 by the federal government under Lincoln. It was Jay Cooke's baby.

(The following summary is largely drawn from Rothbard, A History of Money and Banking in the United States. Rothbard has passed on now, but there has been a book written about him titled, An Enemy of the State: The life of Murray N Rothbard. That being the case and with a title like that, perhaps he might have written a few interesting words, though we start with a quote from Galbraith.)

"The exigencies of war could be urged against the disorder and confusion of the state banks and their notes. A new central bank could not be contemplated but a new system of banks, chartered and regulated by the Federal government, was a possibility. In 1863, at the strong behest of the Secretary of the Treasury (Salmon P.) Chase and the Congress, the National Bank Act was passed establishing a new system of national banks. First attention, as might be expected, was given to the regulation of their note issue. Notes could be issued but only to the extent of 90 percent of the value of Federal bonds purchased by the issuing bank and deposited in the Treasury. The safety of the arrangement will be evident; if a bank capsized, the bonds could be sold and the notes redeemed with, under all ordinary circumstances, a comfortable margin to spare. It was also a useful way of ensuring a wartime market for government bonds." (Galbraith, Money, Whence it Came, Where it went, page 91.)

Now that is a general history one might read in any textbook about the change. But why go to all the trouble, in whose interest was it, and what was to be the effect on the economy ? Such questions must be answered if one is to properly forecast the likely future result, by identifying the vested interests. Let us look a bit more in depth.

In 1860, a new government, with a new agenda, took over. The Democrat hard-money, states rights men were out, the men who believed in a federally controlled national bank system, were in. There was also a war to be fought, won and paid for. Both the North and the South were trying to do this of course, but the North had 'the markets' to back them, and the South was trying to defend the indefensible - slavery. (Never do that, defend the indefensible, like buying a down-trending stock.) We noted already there are only three ways to finance a war. Taxes being rarely popular, the North (and the South) turned to printing notes to pay for supplies. Then the North turned to borrowings, doing so by issuing bonds.

Jay Cooke suggested to Senator Salmon P Chase that the government appoint his firm, Jay Cooke and Company, as the sole agent to raise the necessary money, via bond sales, for the Lincoln administration to finance its operations. The appointment was duly made. The contract Cooke got of course was a total monopoly on the underwriting of the public debt.

"With enormous energy Cooke hurled himself into the task of persuading the mass of public to buy US government bonds. In doing so, Cooke perhaps invented the art of public relations and of mass propaganda; certainly, he did so in the realm of bonds. With characteristic optimism, he flung himself into a bond crusade. He recruited a small army of 2500 sub-agents among bankers, insurance men and community leaders and kept them inspired and informed by mail and telegraph. He taught the American people to buy bonds, using lavish advertising in newspapers, broadsides, and posters. God, destiny, duty, courage, patriotism - all summoned 'Farmers, Mechanics, Capitalists' to invest in loans. Loans which of course they had to purchase from Jay Cooke. And purchase the loans they did, for Cooke's bond sales soon reached the enormous figure of $1 million to $2 million a day." (Rothbard, page 134.) Cooke ended the war a millionaire. 'To be as rich as Jay Cooke' was the expression of the era.

After the successful bond issues, Cooke teamed up again with Chase, and another senator, John Sherman, to put together and push through Congress, a national banking system. This provided for federal chartering of a bank - to be called national banks - which anyone could do provided the reserve specie requirements could be met, though the requirement was not insubstantial. Three types of banks would be permitted, New York banks, Reserve City banks, and Country banks. New York banks had to keep 25 percent of their notes and deposits in either gold, silver or government issued paper - the greenbacks, i.e. this was their 'reserve' requirement. Reserve city banks could keep their reserves as half in gold, silver or notes and half on deposit with New York banks. Country banks were required only to maintain their reserve ratio at 15 percent notes and deposits, of which 40 percent of this could be in gold, silver or greenbacks, and 60 percent as deposits with the national banks above them. So now, instead of the decentralised, individual state banks lending and holding onto their own specie reserves, there was in operation an inverted pyramid. Country banks could lend (expand) on top of reserve city banks, expanding on top of New York banks, at the base of which was a reserve of specie and greenbacks.

To get rid of the myriad state bank notes, the federal government put a ten percent tax on each and every one of them, so they were soon no longer printed. (Illustrates powerfully that the power to tax is indeed the power to destroy.) A national bank could only issue notes: "if it deposited an equivalent of US securities as collateral at the US treasury, so that national banks could only expand their notes to the extent that they purchased US government bonds. This provision tied the national banking system intimately to the federal government, and more particularly, to its expansion of public debt. The federal government had an assured, built in market for its debt, and the more that banks purchased that debt, the more the banking system could inflate." (Rothbard page 142)

As for the state banks, they tended to disappear at first, as was intended, under the weight of the tax on their notes, however, after just a few years the remaining state banks did end up accepting their now subordinate role under the national banks. (Or indeed possibly renew themselves with a federal charter.) In fact: "In order to survive, the state banks had to keep deposit accounts at national banks, from whom they could 'buy' national bank notes in order to redeem their deposits." (Rothbard page 144) State banks became another layer of the banking pyramid on top of the country banks, and soon began to multiply.

Such a system brings us closer to today's current structure (more info later). The upshot: the system, under the guise of wartime commitment, structured so as to "necessarily purchase large amounts of US government bonds… tied the nations banks with the federal government and the public debt in a close symbiotic relationship." (Rothbard page 135) There is a lot in this; no longer an independent government treasury, but treasury funds now 'on deposit' with respected national banks, and a federal government controlled, 'centralised', banking system, which can inflate the supply of credit uniformly. And it might be added, government spending coming into the economy as a debt.

This does not change the fact that banks create credit out of nothing; only the structure of control had changed. And also the way some loans were being issued. Now, if you were granted that all important bank loan, instead of taking the loan in the form of your bank's very own printed notes, the loan could be credited to your account as a deposit, upon which you might write a cheque. The loan, an asset to the bank, (advances to customers) an amount you owed the bank. From the banks point of view, it is still creating its own asset, (from nothing), still backed more than likely by the security, mostly land, you are prepared to offer, in a deal still binding you to future interest payments. And your spending, like that of the governments, also coming into the economy as a debt. Most people still believe banks lend you money out of the funds other people have deposited with that bank. Nothing could be further from the truth.

Click here to see Frontier Banking image

The vested interest and government granted licence.

Beautiful credit ! The foundation of modern society. Who shall say this is not the age of mutual trust, of unlimited reliance on human promise ? That is a peculiar condition of modern society which enables a whole country to instantly recognize point and meaning to the familiar newspaper anecdote, which puts into the speculator in lands and mines this remark: "I wasn't worth a cent two years ago, and now I owe two million dollars."

Samuel L Clemens and Charles Dudley Warner, The Gilded Age; A Tale of Today, page 263.

It was not coincidental that the US got the banking system it did after the end of the civil war. "The Cooke-Chase connection with the new national banking system was simple. As secretary of the treasury, Chase wanted an assured market for the government bonds that were being issued so heavily during the civil war. And as the monopoly underwriter of US government bonds for every year except one from 1862 to 1873, Jay Cooke was even more directly interested in an assured and expanding market for his bonds. What better method for obtaining such a market than creating an entirely new banking system, the expansion of which was directly tied to the banks purchase of government bonds - from Jay Cooke." (Rothbard, page 145.)

The banking creation was quite deliberate. Cooke's father, in writing of Henry, Jay's brother, in a letter to Jay, said: "I took up my pen principally to say that H.S.'s (Henry's) plan in getting Chase into the Cabinet and (John) Sherman into the Senate is accomplished, and that now is the time for making money, by honest contracts out of the government." (Rothbard page 133.)

And further, from Henry, in writing to his brother Jay: "It will be a great triumph, Jay, and one to which we have contributed more than any other living man. The bank had been repudiated by the House, and was without a sponsor in the Senate, and was thus virtually dead and buried when I induced Sherman to take hold of it, and we went to work with the newspapers." (Rothbard page 145.)

For work with the newspapers, it meant this: "As monopoly underwriter of government bonds, Cooke was paying the newspapers large sums for advertising, and so the Cookes thought - as it turned out correctly - that they could induce the newspapers to grant them an enormous amount of free space in which to set forth the merits of the new national banking system. Such space meant not only publicity and articles, but even more important, the fervent editorial support of most of the nation's press. And so the press, implicitly bought for the occasion, kept up a drumfire of propaganda for the new national banking system. As Cooke himself related, 'for six weeks or more nearly all the newspapers in the country were filled with our editorials (written by the Cooke brothers) condemning the state bank system and explaining the great benefits to be derived from the national banking system now proposed.' And every day the indefatigable Cookes put on the desks of every member of Congress the relevant editorial from newspapers in their respective districts." (Rothbard page 145.)

Jay Cooke was now selling the required bonds to all the national banks. He had agents set up new national banks in smaller towns that, under the new system, would of course have to buy the bonds he was marketing. And Cooke also put into place a big bank in New York, the 4th National Bank of New York, capitalised at a very large amount, in order to help stabilise the base of the system, the New York banks. By 1866, this was in place. By 1870: "State banks began to boom as deposit creation institutions. With lower requirements and fewer restrictions, they could pyramid on top of national banks…Total state and national bank notes and deposits rose from $835 million in 1865 to $1.964 billion in 1873, and increase of 135.2 percent or an increase of 16.9 percent per year." (Rothbard page 153.) In other words, an expansion of credit.

The House of Jay Cooke was also expanding; so it was probably only natural to move into the area of railroad bond finance, and perhaps ownership of railroads outright. To quote Cooke directly: "Why should this grand and glorious country be stunted and dwarfed - its activities chilled and its very life blood curdled by these miserable 'hard coin' theories - the musty theories of a bygone age - These men who are urging on premature resumption know nothing of the great growing west which would grow twice as fast if it was not cramped for the means necessary to build RailRoads and improve farms and convey the produce to market." (Rothbard page 156.) By the late 1860's, the Northern Pacific Railroad was in the hands of Cooke and Company. But only after it had been agreed as follows: "that a company shall be organised for the purpose of purchasing lands, improvement of town sites, or other purposes, and the same shall be divided in the same proportion; that is, the original interests shall have one-half, and Jay Cooke & Company shall have one-half." (Sakolski, The Great American Land Bubble, page 293.) In other words, a land grab. We will take up the remainder of this story after a bit about Chicago.

Chicago real estate.

[One of the reasons Hoyt was able to put together such a phenomenal study of Chicago was because of the efforts of George C Olcott and his blue book of Chicago land values, meticulously recording land values for practically every lot in Chicago from 1910 onwards. Prior to that, The Chicago Tribune recorded a good deal of useful land information from 1868, and prior to that the extracts of land titles of the Chicago Titles and Trust Company were used by Hoyt to obtain land sales data. It can be argued that one cannot correctly take Chicago real estate as an exact proxy for what happened to real estate generally throughout the US in any related era or cycle. In addition, there were a few events in Chicago that could rightly be said were entirely unique to that city, one in particular being the great fire of 1871. Nevertheless, it helps us get our head around the activities of the time, through a very well documented case study from Hoyt. And what was going on in Chicago was very much echoed in other developing US cities, as is clearly evident from the literature of the time. This summary of Chicago conditions comes from chapter III of Hoyt's One Hundred Years of Land Values in Chicago.]

For Chicago, the onset of civil war at first intensified the depression following the panic of 1857, especially for the banks until at least 1862. Then the benefits of war conditions kicked in. The Chicago rail lines were soon busy with the newly profitable business of transporting men and munitions. Local firms were soon adjusting to supplying war needs like food, uniforms, wagons and other necessities. The city was also a mecca for draft dodgers and war profiteers. And the war had led to "an inflation of the currency with a resulting rise in prices that presented opportunities for making great profits to the holders of war contracts. The scale of business operations and magnitude of profits were lifted by war to an altitude hitherto unknown." New national banks were opening up too. Land prices had not yet moved however; the speculator focus was elsewhere.

Other developments were continuing. The invention and development of refrigerated rail cars was a great boost to the city's meat industry. Grain markets had been transformed by the needs of war to resemble what we would be familiar with today; traders dealing in the transfer of ownership rights using warehouse receipts and futures contracts, rather than actual inspection and delivery. Expanding markets attracted manufacturing, which attracted workers seeking employment, often with wife and family in tow. The Union Pacific, completed in 1869, put Chicago in direct contact with California, and further trade with the Orient. From 1865 to 1871 the population of Chicago doubled.

Times were changing, needs were changing. "When an increase in the volume of sewage and the industrial wastes poured into the stagnant Chicago River made the stench almost intolerable", works were undertaken to fix it. Efforts were begun to replace plank roads with blocks (wooden or stone), plank sidewalks were put in, bridges built to join either sides of the river. "The precipitous rise in Chicago land values which began in 1865, after reaching a peak in certain downtown sections in 1869, gained a fresh impetus near the parks and boulevards in 1870 and 1871. After a check and decline caused by the great fire on October 9, 1871, the rise again continued during 1872 and the spring of 1873 in certain spots until the record altitude was reached just before the panic of 1873." (There was another fire in 1871; a forest fire in Peshtigo, Wisconsin. In that year, light rain fell September 5th, the only rain since July 8th, 60 days prior. October 8th the most fire damage occurs, a day or two later rains puts out the fire. The largest and most lethal fire in American history. (American Heritage, April / May, 2003.) Note the dates, which give clues as to how events unfold, related to time.) This also begs the question, which few ever point out, of why Chicago land price can recover after the great fire, yet not after the collapse of Jay Cooke. (The story of which will follow shortly) Both are 'unlooked for' events so to speak. The answer has to do with land price, banking and interest rates, and whether the productive sector of the economy can afford the increasing rentals high land prices cause.

Hoyt reports how Potter Palmer, who had recently made a fortune speculating in cotton during the civil war, bought almost a mile of frontage in State Street. (Repeat pattern). He obviously knew what he was doing. Palmer proceeded to give the street a completely new character by moving back the houses on his lots to widen the street. He then built an attractive hotel, enticed merchants and businessmen to the area, gaining cash flow from the rentals. So rapid was the gain in land values in the downtown areas in 1868 and 1869 that it was said to be possible to buy one day and sell the next.

The politicians knew what they were doing as well most likely. They combined with groups of promoters "to secure such public improvements as sewers, water pipes, and wooden-block pavements on the streets they had selected for development as fashionable sections." (Farthest removed one might note from the River - open sewer - and from the odours of the tanneries, slaughterhouses and distilleries situated on either side.) "The working population was barred from these exclusive centres by the price of land, the annual wages of a labourer being insufficient to pay even the interest charges on one of the vacant lots, not to mention the taxes." Meanwhile, in one of the streets where the workers were crowded, "the street may be singled out of a thousand by the peculiar, intensive stench that arises from pools of thick and inky compound which in many cases is several feet deep and occasionally expands to the width of a small lake."

So perhaps it was not surprising that the fame of Haussman's park and boulevard system in Paris was quick to reach a city that was now seeking new outlets for its fashionable expenditure. Reports of the rapid rise of land values in the vicinity of Central Park in New York no doubt also fired the imagination of real estate operators. As would be expected, this added to the general boom. The public participation in land buying began about 1868 when "many cases of large profits made in real estate since 1861 had become common knowledge." By 1871, it was observed that "every other man and every fourth woman in Chicago had an investment in lots." This ferment was no doubt added to by many of the immigrants coming in from Europe, who most probably could not have believed their eyes at the opportunities Chicago presented them after being used to total domination and subjugation by landlords back home. Who could blame them ?

Jay Cooke and the Northern Pacific, part II

Construction of the Northern Pacific (NP) railroad, once Jay Cooke had taken up the financing required, started in July 1870, after $30 million had been raised. Cooke raised the finance selling NP bonds, the same way he had sold government bonds. He hired writers and pamphleteers to distribute widely the benefits of the north-west: its Mediterranean climate, its forest mountains and plains where bumper crops of grain and fruit could be grown, a vast wilderness 'waiting like a rich heiress to be appropriated and enjoyed'. He put many leading politicians and government officials on the NP payroll. Perhaps the fact that Cooke was owner of 40,000 acres of land in and around Duluth helped him understand such climatic attractions. (Twenty feet of snow is not uncommon in winter.) But as time went on, as fast as Cooke could raise the finance for the line, the money was spent building it. Probably, Cooke and Coy, in the conditions of the time, overestimated its abilities. In the lead up to 1873, with Cooke now considered the nation's most prestigious and rock-solid banker, this would prove to be disastrous.

Into the peak.

"If speculators could find unlimited credit, one can't tell what crises would ensue."

Baron James de Rothschild, testifying before the 1865 French Enquete (inquiry) into monetary circulation, acknowledging that rising interest rates could be relied upon to cut down speculation in commodities and public funds. (Quoted in Kindleberger; Manias, Panics and Crashes, page 126.)

Hoyt records that in the ten years autumn 1862 to spring 1873, Chicago land values as a whole increased 500 percent, and values were 360 percent higher, on the average, compared to the 1856 peak. On the city outskirts, gains of 1000 percent were not uncommon; such was the combined effects of the rails, horse-car lines and the parks. Still, there was as yet "no fear of a collapse of the structure of land values that had been reared so high during the last ten years." Only a deflation brought on by yet another catastrophe like the panic of 1857, the civil war, or great fire could do that. Or so it was thought.

But things rarely unfold in the manner in which they are built. Developments that had previously been regarded as normal, bridge building, paving, and all the improving, had one thing in common; built at high cost on borrowed money. And much real estate activity was now being done on small initial down payments. Again that illusion of wealth, and optimism at the top. Real estate men were forecasting Chicago would be the largest city in the world.

Reading the tea leaves.

Whenever business is looking brisk and busy, one should always note who are the heaviest borrowers of capital. Such a business will be impacted materially by the movement of interest rates. The biggest borrowers of capital at this time were the railroads. But not far behind were the land speculators and those paying for landed improvements, the municipal governments. Signs of distress before a panic will be there, though rarely obvious: it is not in the interests of too many people to have this pointed out. By early 1873, the NP line was paying its workers in scrip, rather than cash, and Jay Cooke and Coy was probably deeply overdrawn as regards its own financial obligations to other banks. But such a condition will of course never be advertised to the market; in fact a company would make their best efforts to conceal it. (However business owners and market insiders will know and be acting on the information without informing others, which will eventually cause stock prices to move accordingly.) Astute observers at this time should have been able to notice that a lot of capital was being tied up in ventures yielding, at least initially, very little income and subject to escalating interest costs: both in railroads and land speculation. The interest bill for the rail lines alone was estimated at around $80 million even in 1868. (Lightner, History of Business Depressions, page 160.) This could not go on forever. Added to these troubles, the railroads were beginning to come under attack from the so-called 'Granger movement'; groups of farmers banding together to counter what they saw as predatory pricing and monopoly control of commodity shipments via rail. The Grangers were seeking, and often got, state legislative restrictions on what the rail companies could charge on freight. This was not helping railroad companies cover their debt payments. (Remember, the profits from the land sales alongside the lines often flowed to a different company set up for this express purpose.)

Production statistics, if any were kept or could have been gathered (we have the benefit of hindsight) and most other things about the year 1873 would have given the appearance of the utmost prosperity at this time. Plenty of money around, plenty of things to spend it on and everyone busy. But appearances can be deceptive. In an economic sense it is the earnings that have to be watched. Or more correctly, the anticipated future earnings of the main sectors of the economy. The stock market can tell you this - if one can correctly read a chart - because stock markets always manage somehow to correctly discount future earnings. This is where the chart reading skills of the great W. D. Gann, or of Charles Dow come in. But we are ahead of ourselves by a cycle or two presently.

The panic.

On September 8 (1873) The New York Warehouse and Security Company suspended operations and admitted it was insolvent, having lent to railway construction companies and individual rail builders who themselves were now insolvent. This was a sign of trouble. Then on the 13th, a Saturday, Daniel Drew's firm of Kenyon, Cox & Co. admitted difficulties and closed its doors. Drew had lent $1.5 million to the Canada Southern railway and the loan now looked doubtful. The Street now had the rest of the weekend to think about the solvency of other railway corporations.

The Monday was quiet. Tuesday saw a few further failures, but minor companies only. First signs of a possible panic appeared on the Wednesday (17th), in the morning, though there was no bad news released to cause the decline. "The Herald reported that market insiders seemed to expect a major news item to shake the market and were unloading so as to be prepared to pick up bargains later on." (Sobel, page 177) Short selling was on the rise.

In the summer of 1873, May to September, Hoyt reported a falling off of the cash resources of intending real estate buyers. And when this seemed to halt the rising land values, "the desire to purchase land fell off sharply, for nothing so quickly stops an upturn as the belief that a commodity can be bought next month or next year at the same price." A revival of the property market was being anticipated in the autumn, as per usual, however the September 18th announcement in New York of the failure of Jay Cooke and Company startled investors. Indeed, the initial reaction to the collapse of America's most prestigious banking concern was disbelief. In Pittsburgh a paperboy was arrested for shouting out the news, because it was news which police had not yet heard and believed the paperboy was making it up to garner more sales. "Incredulity soon gave way to panic, as the stock market collapsed and daily call rates rose to 5 percent." (Chancellor, Devil Take the Hindmost, page 185.)

Chancellor describes the events this way: "The next day, crowds thronged the financial district to witness the unravelling of the speculative drama that had entranced the nation for the past decade and a half… Vanderbilt's son-in-law, Horace Clark, was found dead after the failure of the Union Trust Bank, from which he had borrowed heavily to finance his margin speculations. Daniel Drew, the Old Man of the Street, took his final curtain call as his brokerage, Kenyon, Cox and Co, was swept away in the panic. Declared bankrupt, Drew retreated to his bed…he died a year later. When the panic continued into Saturday, the President of the New York Stock Exchange announced that for the first time in its history the exchange would close - until further notice."

Historian Alfred Chandler, (page 506), about September 18th wrote: "On the day of the Jay Cooke failure, these shares dropped in price so suddenly and sharply that banks and prominent brokerage houses collapsed like pins in a game of ten-pins. On the street, within the shadow of the stock exchange, some men wept and some attempted suicide at the realization of their financial ruin. I saw all this, as I was in the midst of it and it made a lasting impression."

The stock exchange was shut down. No one knew for sure when it might re-open. Money could almost not be had; one and a half percent per day was the going rate for a bank loan - if you could get one. (Lightner, History of Business Depressions, page 161.) The banks, like everyone else, began hoarding cash.

Back in Chicago, there was no immediately serious drop in land values. If any lot holder was hard pressed for cash, a ready market for his lot could be found, at about 20 percent discount to previously prevailing prices. This was helped by a continued abundance of loan funds offered to renew mortgages. But time was putting things into reverse. Unemployment was growing, reducing pressure on the need for rental space. For property owners facing lower rental payments, their fixed interest charges and building costs were still the same. The legendary reserve powers of property owners were being slowly whittled away.

Banking unrest, cash withdrawal suspensions, sometimes the closure of the bank itself spread selectively down the Eastern seaboard, then spread to the middle of the country. Some serious bank runs developed in Chicago. (Wicker, Banking Panics of the Gilded Age, page 21.)

The New York stock exchange did re-open; ten days after it closed, though 'unofficial' trading had continued outside the exchange on the streets, on New Street in particular, despite Exchange board warnings that such behaviour by member firms was punishable by expulsion from the exchange. Few heeded the warning. The panic was over, but the depression had only just started. (A depression second only in its effects to the 1930's.) "Throughout the following winter factories closed down, railroads discharged employees, banks failed, wages were cut, and money was hoarded. By the end of 1873, over five thousand commercial failures had been announced, among them the Northern Pacific Railroad and nearly fifty New York brokerages. In January, a crowd of unemployed protesters rioted in Tompkins Square New York, and were charged by mounted police…By 1877 it was estimated that only a fifth of the labour force was in regular employment. Strikes and unrest became frequent…in New York a religious revival movement thrived in response to the apparent endlessness of the depression." (Chancellor, page 186.) God called to the rescue yet again.

In Chicago, "the bank failures that had followed in the wake of the panic of 1873 culminated in 1877 with the failure of the largest savings bank in the city…Serious labour riots broke out all over the United States, and on July 5th 1877, a pitched battle was fought between the police and a great mob…in which twenty were killed and seventy injured. In this period, when capitalists were frightened by the industrial disturbances, twelve thousand loans for a total of $50 million that had been made by local property owners to finance the rebuilding after the fire, fell due. Scant capital was available for refunding these maturing obligations or for buying property at any price. Wealthy men were hoarding their money because currency was constantly appreciating in terms of gold, while lands and commodities had been constantly declining in terms of currency." (Hoyt, page 123.) The action of credit in reverse.

One speculator, a Samuel H Walker, worth $15 million in 1873, had lost the lot by 1877. In this year, it was being frankly admitted that a return to pre 1874 property levels was not only highly unlikely, but that the values at that time were probably the result of an hallucination. The decline in some Chicago land values was 90 percent, but on the average about fifty percent. Jay Cooke went on to extricate himself from the bankruptcy of his firm, which he managed by judicious later selling of his land holdings around Duluth, but he never fully recovered his pre 1873 status. (The vacuum he left was taken over by J. P. Morgan.) Cooke's Northern Pacific line was reconstituted and construction begun once again, falling into the hands of Henry Villard in 1881; the land side of the company going on to employ some 800 land agents to assist immigration from all corners of the globe to add value to its land not already sold. Another cycle, same result.

An international perspective.

The 1873 panic and downturn was not just an American phenomenon. Railroad expansion was occurring everywhere, so too the required credit creation by banks that financed it. There had been a number of European building booms, the opening of the Suez Canal in 1869 (which wrought huge economies of scale in shipping) and the excitement of German unification under Bismarck, all feeding extensive further speculation by the Europeans, the Germans in particular. The Vienna stock exchange underwent a panic on May 9th (1873), spreading to Germany, Italy, Holland then Belgium. The US suffered in September their panic, which spread in a contagious fashion to England, France and finally to Russia. A protracted economic slowdown followed this year 1873 for quite some years, extending into the 1890's really. In 1875, Baron Carl Meyer Von Rothschild was heard lamenting to friends the state of low stock prices everywhere, saying: "The whole world has become a city." (Kindleberger; Manias, Panics and Crashes, page 121.)

The scandals.

This time, the scandals, swindles, scams and frauds had already been coming out thick and fast before the peak year and as usual continued well into the downturn. There were plenty, including:

- The Indian trading post scandal; in 1875 William W. Belknap, secretary of war, was impeached by Congress for allegedly accepting bribes from employees in the government Indian service, in his role as seller of government trading posts in the West.

- The whisky ring (exposed 1875); the selling of US made whisky without the excise tax, thereby defrauding the government of the revenue. An association of government revenue agents, politicians, grain dealers and distillers in St Louis, Milwaukee, Cincinnati and other cities were implicated, as was the president's private secretary, Orville E. Babcock. The gains, starting in about 1870, were estimated at over $2 million, 200 men were indicted. The distillers would bribe the government officials so that the taxes collected could be retained. The money was then used to finance various political activities, thwart investigations and buy off the investigating journalists.

- The Dominican Republic fiasco; in 1870, Buenaventura Baez, then dictator of this small republic sought to sell it, yes the whole country, to the United States. The President liked the idea, sending his private secretary to have a treaty signed, which did actually take place. The senate did not ratify the treaty however.

- The New York customs rent scam; a system of corruption whereby the customs house was granted a full monopoly over the storage of imports, leading the controller, Colonel Leet, (personally appointed by the president) to charge one months rent for just a day's storage on the wharf, surplus funds accruing to the colonel of course.